MobilityMonday: We, Robot "show" marks the death of Tesla the EV OEM and the emergence of Tesla the mobility ideal

Volume 9

Each Monday, I’ll be breaking down a recent development affecting the economy of the movement of people and goods. To follow along for the journey, enter your email below to subscribe.

Tesla unveils Cybercab, Robovan, and upgraded Optimus as it tries to recapture the limelight, but leaves out details about its ambitious goals

The past week has been a busy one for Elon Musk, starting last Sunday with an inaugural appearance at one of Donald Trump’s presidential campaign rallies and ending yesterday with SpaceX’s first successful recapture of one of Starship’s Super Heavy rocket boosters. Sandwiched in between the two was Tesla’s much-anticipated We, Robot event last Thursday, which promised to unveil the company’s long-promised robotaxi product.

At Warner Brothers Studios in Los Angeles, Musk unveiled three marquee reveals:

Cybercab, the gold-colored mini-Cybertruck-looking robotaxi devoid of a steering wheel, gas and brake pedals, and most any other passenger-facing controls outside of a sleek touchscreen.

A 20-seater autonomous mass transit vehicle called the Robovan (seemingly pronounced ruh-BO-vehn).

Finally, the Steve Jobs-esque “one more thing” moment came with the unveiling of the latest version of Optimus, Tesla’s humanoid robot. (They looked sleek, but the demo droids were at least somewhat operated remotely.)

There’s much to be made of the announcements and reveals last Thursday, but some things that stood out to me include:

Charging:

Musk announced that Cybercab would be only chargeable via inductive charging. This comes a year after Tesla’s NACS charging connector fully transitioned from proprietary to de facto industry standard. Building and scaling public and private charging infrastructure has proven to be hard enough, so introducing a whole new norm threatens to mitigate some of the recent momentum. Tesla is clearly trying to maintain some sort of protective moat now that NACS is no longer a lock-in mechanism.

Autonomy:

Tesla continues to give the proverbial middle finger to the rest of autonomy by betting its future on a camera-only autonomy stack. Although Musk’s argument of “Humans don’t have radars and lidars, so why do cars?” might make sense at face (and economic) value, the lack of redundancy and advanced sensing will likely make Cybercab (and FSD more broadly) a tougher sell to both consumers and regulators. Cameras aside, there are still a lot of unanswered questions about how Tesla plans to tackle some of the most challenging issues in autonomy in which others have failed or struggled.

Commercialization:

Leaving something with more questions than you came into it with can be a sign of a fruitful dialogue, but it didn’t feel like this was the case. We, Robot felt more like a continuation of Musk’s lofty and perpetually delayed technological promises with questions abound:

How realistic is a sub-$30k price tag for both the Cybercab and Optimus?

To what extent is Tesla an owner-operator versus just a retailer of its mobility services from factors?

How will antitrust and safety regulators react to a company already under immense scrutiny?

And once and for all, what data is actually being collected from Tesla product owners to power the future of the Tesla product suite?

Finance:

When most companies reveal three futuristic products and show an apparent path toward a tech-driven future, the public markets usually react positively. So why then did Tesla’s stock instead take a 9% nose-dive?

Tesla has never been priced in the public markets as a typical automotive OEM. Tesla has a market cap of $683B and trades at a 61x revenue multiple. By comparison, GM sells at least 3x more vehicles than Tesla does each year but trades at only $54B and a 5.4x multiple.

As such, Tesla is trying to justify its software-style stock profile by banking on autonomy and the future of AI-enabled hardware. But Tesla’s announcements last week were met with a high degree of skepticism — thin on technical details and business models combined with little mention of geopolitical considerations. Ultimately, this lack of clarity resulted in stock volatility, something which, say what you may about them, traditional OEMs have experienced much less of. (Meanwhile, Uber and Lyft’s respective stocks seem to have benefitted from “Tesla’s ‘toothless’ robotaxi reveal.”)

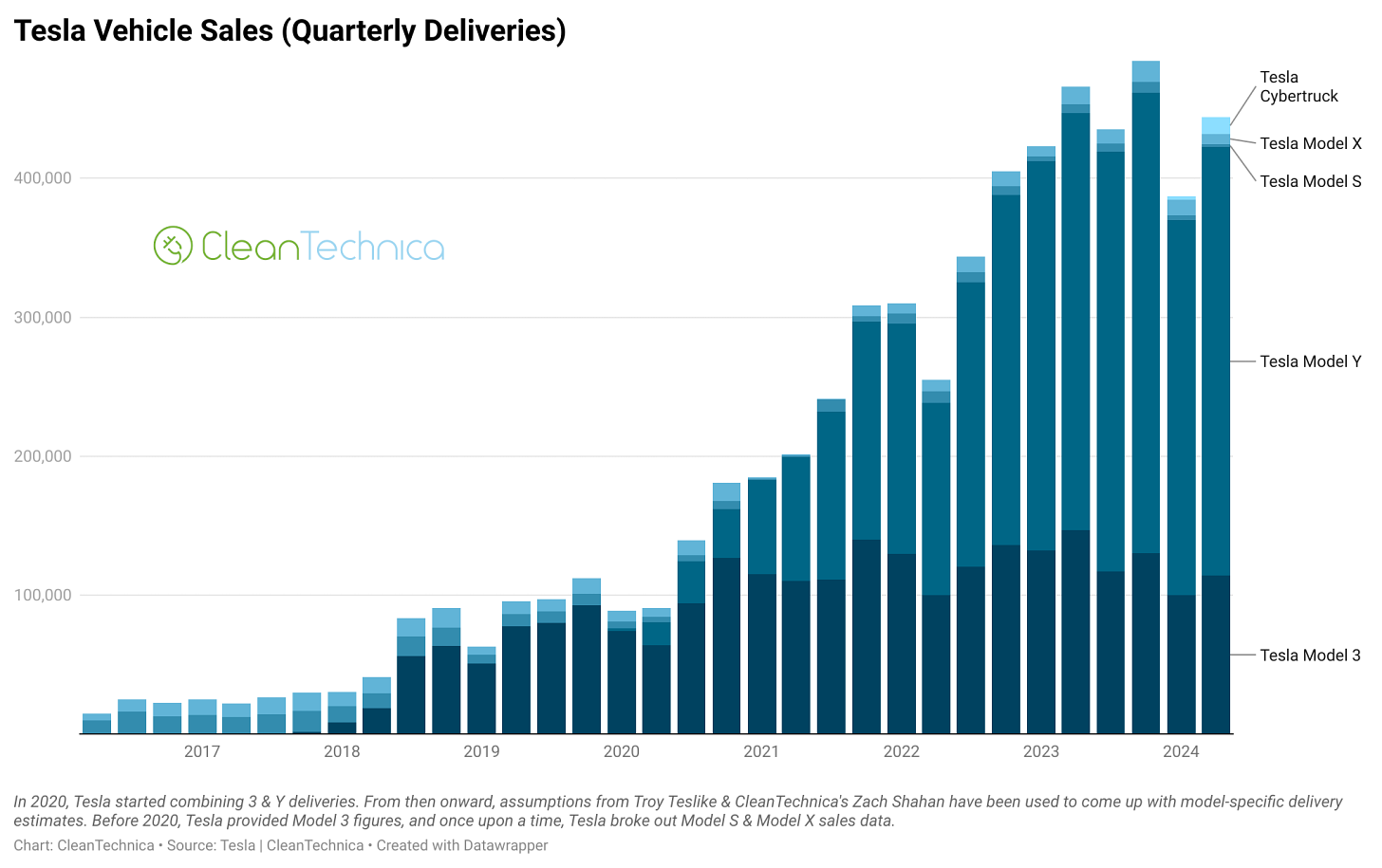

Tesla’s EV market share in the US dropped below 50% for the first time. Quarterly sales have plateaued as other OEMs have begun to catch up on EVs.

Thursday felt like the death of Tesla the EV OEM and (re)birth of Tesla the end-to-end mobility services platform and/or TeslaAI. The company knows that its time atop the EV world is coming to a close — especially as the US and EU seem to be backstopping local legacy OEMs at all costs — and it must find new ways to recapture the spotlight, even if they may be late to the party in some ways.

👜 Grab Bag

European carmakers plan dozens of cheaper models to survive ‘EV winter’

Uber Will Now Take You From Manhattan to LaGuardia for $18

After Hurricane Milton, a growing risk: Flooded electric cars going up in flames