Each Monday, I’ll be breaking down a recent development affecting the economy of the movement of people and goods. To follow along for the journey, enter your email below to subscribe.

In a world of increasing energy distribution and de-aggregation, Engrate is building the connective digital tissue to access the flexibility markets

As an American expat, I often need to convert Israeli shekels to US dollars, and vice versa. I typically do so using Wise, which allows me to seamlessly connect to my US bank account by virtue of the company’s partnership with Plaid, the preeminent fintech data transfer network. It looks something like this:

See how easy that was? No need to provide my credentials via a human being or in a separate pane of glass. No need to wait days for confirmation of connectivity.

More importantly, but unseen to the naked eye, lies another wonder: the fact that there’s also no need for the Wise engineering team to build out integrations to each and every one of the 4,487 FDIC-insured banks in the United States. Each backend software integration could take weeks, if not months, for the Wise team to build out on their own. Multiply that by 4,487, and you can see why the Wise team would want to outsource that work to Plaid.

So what does a fintech like Plaid have to do with MobilityMonday?

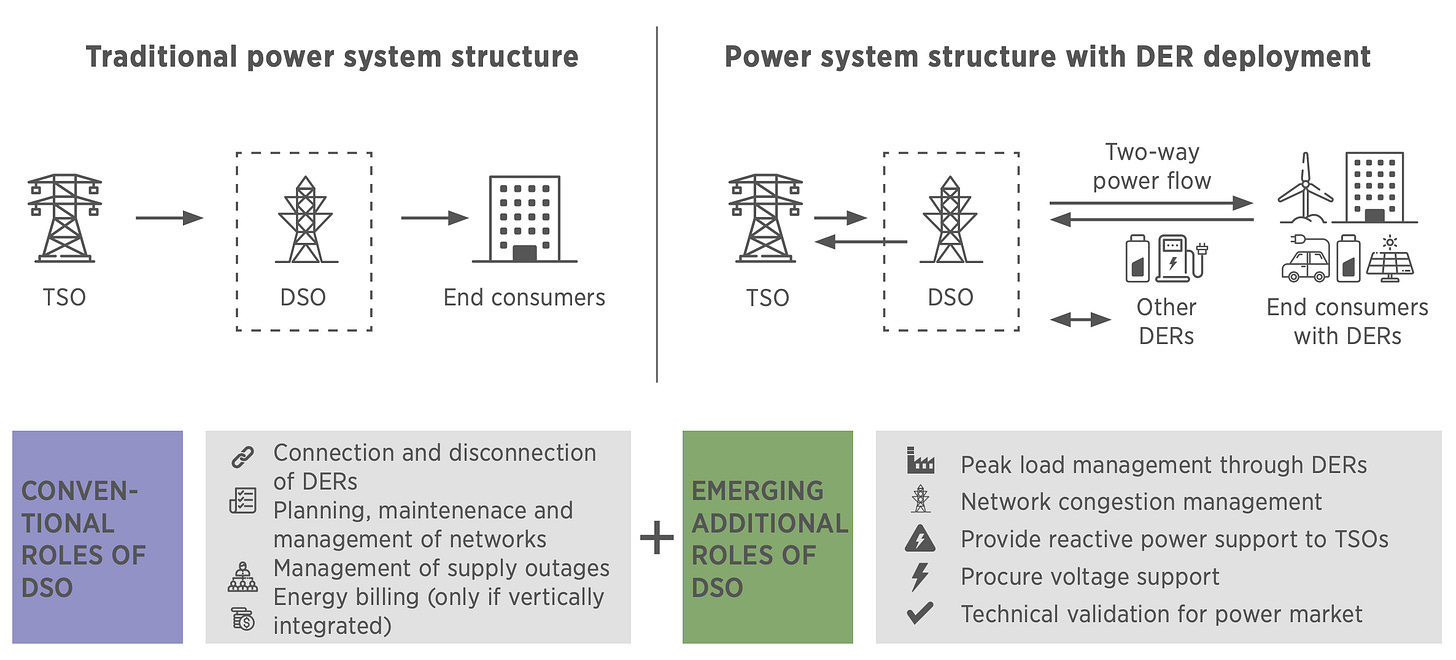

Well, with the energy transition in full swing, the electric grid is becoming more complex than ever. Particularly in Europe, the energy market is characterized by the increasing decentralization and localization of energy production and distribution. In other words, power generation is happening closer to where it is being consumed, thanks in large part to distributed energy resources (DERs) like solar panels, EVs, and small-scale energy storage systems.

Concurrently, there are more than 2,500+ distribution system operators (DSOs) and 40 national-level transmission system operators (TSOs) that make up the nervous system of Europe’s electricity grid. In combination with traditional energy trading, the proliferation of DERs endpoints is resulting in increasing flexibility for the power markets thanks to the rise of virtual power plants (VPPs) and other software-driven energy flexibility tools.

Today, VPPs and any other company that needs access to the energy flexibility markets are each building out the backed integrations to the relevant TSOs and DSOs. But what if there could be a tool like Plaid that could free up precious engineering hours from building out the proverbial software piping to the thousands of transmission- and distribution-level operators?

Enter Engrate.

Engrate is developing a purpose-built, AI-ready unified API to transform the energy flexibility markets. Maniv is proud to have led Engrate’s €2.5M Seed round — with participation from Eviny Ventures and CC.VC — which was announced last month.

Headquartered in Stockholm, Sweden, Engrate was founded in 2024 by Anna Engman (CEO) and Richard Eklund (CTO). Anna is a tenacious five-time founder whose experience spans the enterprise marketing and climatetech ecosystems. Richard brings more than 15 years of software engineering leadership, from Spotify to Volvo Cars, and most recently as CTO of Tibber, the European digital utility soonicorn.

Whereas healthcare, financial services, HR, e-commerce, and other verticals have already spearheaded the use of leveraging unified APIs to build derivative third-party products, the electric grid is lagging in this respect. With its own unified API offering, Engrate is bringing a well-proven business model to the under-digitized energy market. By partnering with Engrate, the plethora of European VPP companies, energy trading platforms, neo-utilities, and energy retailers can now benefit from a standardized, seamless connective tissue to access the grid-level and geography-dependent energy flexibility markets.

Congratulations to Anna, Richard, and the growing Engrate team! ⚡ To learn more about Engrate, visit engrate.io.

👜 Grab Bag

How Renault is speeding up car development to match Chinese rivals

Octopus Energy unleashes Kraken: £10bn spin-out set to disrupt global utility tech

Slate Auto drops ‘under $20,000’ pricing after Trump administration ends federal EV tax credit