MobilityMonday: China's battery export ban on Skydio represents new level in drone (supply chain) warfare

Volume 12

Each Monday, I’ll be breaking down a recent development affecting the economy of the movement of people and goods. To follow along for the journey, enter your email below to subscribe.

Following the US government’s spats with DJI, China cuts off batteries from America’s B2B drone leader

Last Wednesday, Skydio — the US’s largest commercial drone manufacturer — announced that it had been hit by sanctions imposed by the Chinese government. The sanctions prevent Chinese companies from doing business with Skydio, which alleges that the sanctions emanated from the fact that the company sells drones to Taiwan’s National Fire Agency.

In a public letter, Skydio CEO Adam Bry announced that the sanctions would severely hamper the company’s ability to source batteries, one of the only components of its supply chain to originate from China. For now, the company is rationing battery per drone as it looks in the coming months to secure new agreements with non-Chinese battery suppliers.

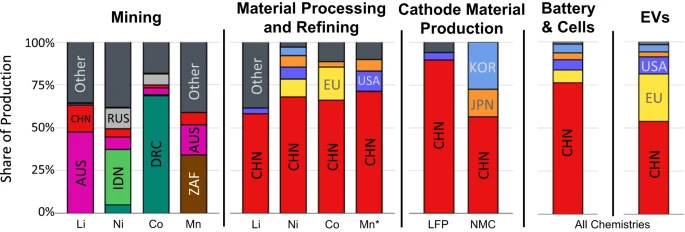

It should be no surprise that China has chosen batteries as a bludgeoning bargaining chip in exacting its foreign economic policy. Not only does China control the overwhelming majority of battery mineral processing and refining, but it also produces more than three-quarters of battery cells worldwide. And despite efforts in the West to re-establish local battery supply chains, China will still dominate the battery market well into the next decade.

Bry also asserted in his letter that the ban “is an attempt to eliminate the leading American drone company and deepen the world’s dependence on Chinese drone suppliers.” He’s not far off.

DJI is the largest drone manufacturer in the world, accounting for more than 70% of global commercial drone sales and an estimated 90%+ in the US. In 2021, the company brought in an estimated $3.83B in sales.

On the other side of the Pacific, Skydio has raised more than $700M in venture dollars since its $3M Seed round in 2015 led by a16z. A decade later, the company now sells to more than 1,200 B2B customers, including every branch of the US DoD, more than 200 US public safety agencies, and dozens of energy utilities.

Given Skydio’s ascent, the tension between the company and China’s home team in the drone market is only heating up. Even before the latest announcement by Skydio, the US government had taken political and legislative action against DJI:

Two months ago, the US House of Representatives passed HR 2864, or the Countering CCP Drones Act, which would effectively ban the sale of new DJI drones in the country by preventing them from operating on US communications infrastructure. The bill now awaits further deliberation in the Senate.

Two weeks ago, DJI sued the US DoD over the Pentagon’s designation of the company as a “Chinese military company.”

The buzz isn’t just happening in the commercial market; China has also been running toe-to-toe with the US’s capabilities in the military drone market.

So while the military drone warfare of the future is very much here and now — something we’re seeing every day from Ukraine to Israel — economic drone warfare is just as present.

How far could China take these economic chokeholds? Will CATL soon no longer supply batteries to Tesla, BMW, Ford, and Mercedes if they continue to sell in Taiwan, where they currently represent four of the top 10 automotive brands?

Time will tell, but we should know a bit more about the US’s posturing after tomorrow. Happy Election Day! 🇺🇸

👜 Grab Bag

Volkswagen profit plunges 42% in third quarter amid sweeping overhaul plans

Ford Motor to Pause F-150 Lightning Production for Several Weeks

Zoox custom robotaxis are finally coming to San Francisco and Las Vegas